Manual payroll calculator

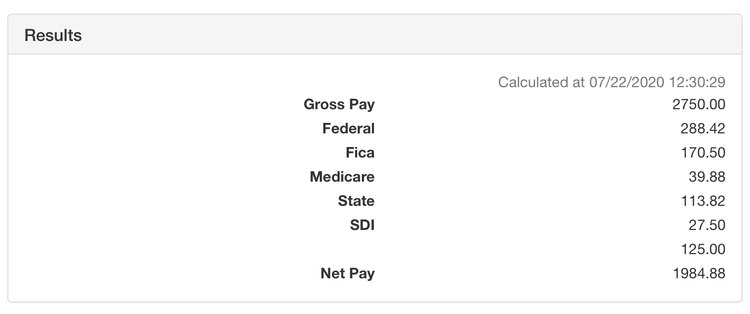

Lump Sum Net Pay Calculator - 2021. ROI Calculator Service Support.

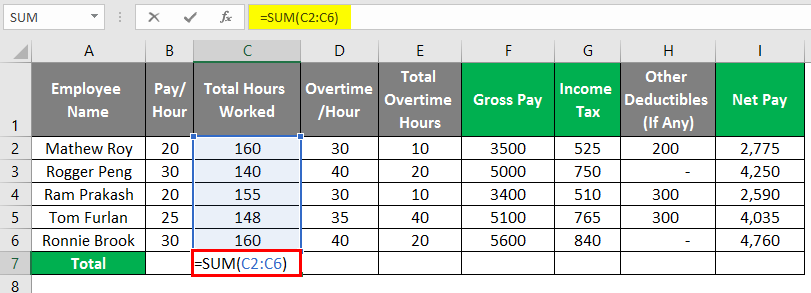

Payroll Calculator Free Employee Payroll Template For Excel

Outsourcing reduces the cost of payroll processing.

. Creating a manual eliminates confusion. Manual payroll processing can be quite time consuming. The time card calculator will help you with payroll.

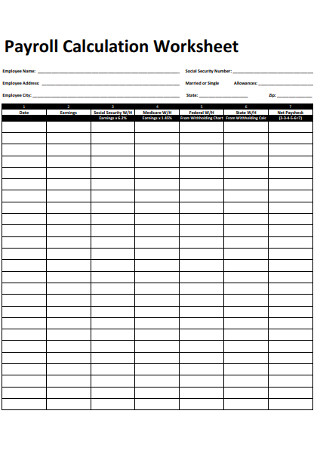

Forms - Payroll Documents on this page are in Adobe pdf Word doc Word docx and Excel xls formats. Once you have defined the policy the next step is to start collecting your employees inputs. Almost all national payroll service providers offer a tax.

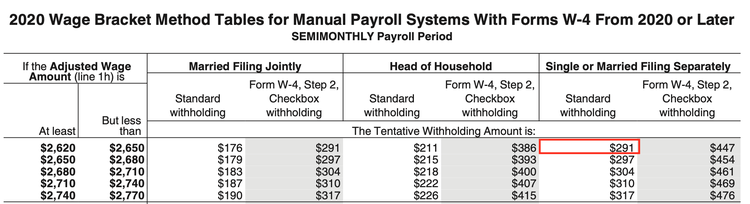

See whos working when and where all in real time on the web. The instructions are different based on whether you use an automated payroll system or a manual payroll system. Bi-weekly Terminal Benefits Calculator with Deferral - 2021.

Get detailed payroll reporting. Monthly Terminal Benefits Net Pay Calculator - 2021. The worksheet walks you through the calculation including determining the employees wage amount accounting for tax credits and calculating the.

By outsourcing the process you can free up your staffs time which they can use in pursuing other activities that generate revenue. QuickBooks Payroll Software helps small businesses to run and manage payroll seamlessly and hassle-free. OBFS Policies and Procedures Manual.

Run payroll reports in just a few clicks. Weve all done it. Sync changes between HR benefits and payroll.

Create custom fields and report on them from an intuitive all-in-one platform. Hit the spacebar mid-spreadsheet on Excel and deleted a formula without. For example assume that the accountant who is responsible for reconciling the bank account goes on vacation.

Use payroll stub templates to conveniently generate detailed pay stubs for each of your employees. It reduces costs. Easy to include lunch or break time and deduct it from total hours.

Templates for payroll stub can be used to give your employees their pay stubs in both manual and electronic formats. To complete a paper copy off-line download and print the pdf file. Already Have an Account.

Payroll management encompasses the entire process of calculating employee hours paying employees withholding taxes and maintaining the financial documentation for your business. Payroll by direct deposit and affordable and accurate tax filings. You can avoid IRS penalties.

Her backup can refer to the procedures manual to reconcile the account accurately. Collect and Verify Inputs. Change W-4 in My UI Info.

Also you can use the timesheet calculator as an employee too. Late payments miscalculations theyre all part and parcel of manual entry. The Payroll Procedures Manual PPM prescribes detailed payroll procedures not provided elsewhere and coordinates instructions of various authorities on specific payroll subjects.

On most payrolls an employers payroll system will withhold federal and state income taxes from an employees payroll. To simplify taxation export your general ledger and manage salaries and benefits enrollment all while reducing manual and paper processes. Save 50 for 3 months.

How to Make a Payroll System in Excel. Section M - Monthly Payroll Certification reformatted version revised 0913. Streamlined automated payroll cost calculations vs manual calculations.

No manual calculation needed. These include employees PAN numbers addresses bank details and other important information. Creating a manual payroll calculator can be tedious but Microsoft has a free payroll calculator template for Excel for both Windows and Mac computers.

The IRS income tax withholding tables and tax calculator for the current year. Section L - IDL Supplementation Calculator reformatted version revised 08222017. A manual serves as your primary tool to train new employees and to cross train workers on tasks.

Verify Your W-2 Totals Calculator. January 31 2022 The withholding statement information Forms W-2 W-2G and 1099 Series must be reported to the Kentucky Department of Revenue DOR on or before the January 31 due date. Skip To The Main Content.

Global Payroll Calculator is a one-click tool for global businesses and service providers to calculate and compare payroll taxes and employment costs worldwide. Yes with real humans. Manual Vs Automated Payroll Processing Winner Revealed.

It is the best way to maintain the working hour records for employees. SurePayroll is a Small Business Payroll Company providing Easy Online Payroll Services such as Payroll Tax Services Accounting Services and 401k Plans. Eliminate buddy clocking by tracking their GPS voice or device.

Eliminate manual errors with an integrated timeclock. Department of Accounts EDI Unit PO Box 1971 Richmond VA 23218-1971 EDI User Guide PDF. Payments to Foreign.

Free set-up no hidden fees pay as you go. Automate the stuff you hate. NannyChex is the best payroll and tax service for your nanny caregiver and all household employees.

Spend less time doing payroll. Isolved People Cloud includes cutting-edge payroll processing software that is designed to simplify the way you pay your employees. Since 1995 our superior service value and expertise have made NannyChex a leader in the household payroll industry.

A Kentucky Online Gateway KOG user account email address and password is required to file Form K-5. Any change made for an employee from personal details to compensation go seamlessly from manual to automated capturing every modification synced between systems. Its 100 safe to use.

Try it save time and be compliant. Free Microsoft Excel payroll templates and timesheet templates are the most cost-effective means for meeting your back office needs. Integrate with your accounting software to.

Advantages of Timesheet Calculator.

How To Calculate Payroll Here S A Quick And Smart Method Timecamp

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

A Small Business Guide To Doing Manual Payroll

Payroll Formula Step By Step Calculation With Examples

Free 8 Sample Payroll Time Sheet Calculator Templates In Pdf Excel

Payroll In Excel How To Create Payroll In Excel With Steps

How To Calculate Federal Income Tax

How To Do Payroll In Excel In 7 Steps Free Template

How To Do Payroll In Excel In 7 Steps Free Template

How To Calculate 2019 Federal Income Withhold Manually

A Small Business Guide To Doing Manual Payroll

Payroll Calculator Excel Template 2022 Paycheck Spreadsheet

How To Calculate Payroll For Hourly Employees Sling

Payroll Calculator Free Employee Payroll Template For Excel

How To Calculate Payroll Taxes Methods Examples More

The Cost Of Manual Payroll Human Error Calculator

21 Sample Payroll Templates Calculators In Pdf Ms Word Excel